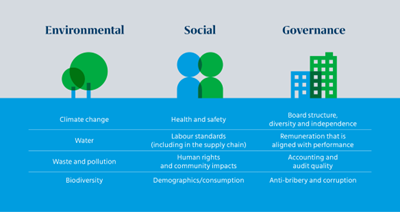

Environmental, Social, and Governance (ESG) investing has gained immense prominence in recent years, with investors increasingly considering a company’s environmental and social impact, as well as its governance practices, alongside financial performance when making investment decisions. Global ESG assets are on track to exceed $53 trillion by the fiscal year 2025, and total investment in U.S. ESG funds is expected to more than double to $10.5 trillion by 2026.

Leading the ESG Movement: PepsiCo, Salesforce, and Cisco Systems

Companies such as PepsiCo, Inc. (PEP), Salesforce, Inc. (CRM), and Cisco Systems, Inc. (CSCO) are presently leading the ESG movement. PEP, for example, has paid consecutive quarterly cash dividends since 1965 and has a trailing-12-month gross profit margin of 53.38%, which is 69.3% higher than the industry average. In addition, PEP’s Frito-Lay North America (FLNA) announced its first-ever third-party shipment of an Electric Vehicle (EV) with Schneider National Inc. (SNDR).

ESG Funds: Focusing on Social Aspects and Assessing Risks

ESG funds are increasingly focusing on the social aspect, including diversity, equity, and inclusion efforts. ESG criteria are seen as a new way to assess the risks a company faces rather than simply as a screen to weed out certain companies or industries. Despite

Republican resistance to funds that screen out oil, natural gas, and coal companies, ESG investing is here to stay.

Seven of the Best ESG Funds

Some of the best ESG funds include Etho Climate Leadership US ETF, AXS Change Finance ESG ETF, Democracy International Fund, Nia Impact Solutions Fund, VanEck HIP Sustainable Muni ETF, AXS Green Alpha ETF, and First Trust Nasdaq Clean Edge Green Energy ETF. For example, Etho Climate Leadership US ETF eliminates all fossil fuel, tobacco, weapons, and gambling companies from its index and has an expense ratio of 0.47%.

ESG Investing: Short-Term Challenges, Long-Term Stability

ESG investing may drag down returns over the short run by avoiding the volatile energy sector, but it may provide more stable returns over the long run. As investors continue to prioritize environmental sustainability, social impact, and strong governance practices, ESG investing is expected to play a significant role in shaping the future of the financial industry.