Fintech has made significant strides in revolutionizing the way people manage their finances, making it easier than ever to get started. Investment platforms offer a range of options, from robo-advisors that use algorithms to manage your portfolio to social trading platforms that allow you to follow and copy the investment strategies of successful traders. These platforms often have lower fees than traditional investment management services and provide easy-to-understand data and analysis to help you make informed investment decisions.

Developments in Financial Infrastructure

Developments in Financial Infrastructure

New financial infrastructure is impacting organizations, people, and economies around the world. Digital payment channels have transformed how consumers and companies transact, increasing access to financial services and fostering economic expansion. Blockchain technology offers transparency, security, and trust in transactions, quicker settlement procedures, efficient recordkeeping, and increased data privacy. Open banking, made possible by APIs, allows financial institutions to work with third-party service providers and offer individualized financial services, seamless platform integration, and cutting-edge financial products.

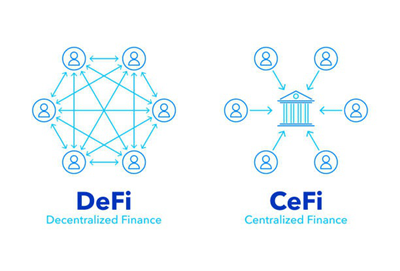

Decentralized Finance (DeFi)

DeFi is a disruptive force in the financial industry, offering transparent, open, and permissionless financial services like lending, borrowing, and yield farming. Regulatory frameworks and compliance requirements are essential to ensure consumer protection, data privacy, and financial stability while new financial infrastructure is developed. Security concerns, cybersecurity threats, and data breaches necessitate strong security measures and industry cooperation, and implementation difficulties are brought on by regulatory harmonization and platform interoperability.

Artificial Intelligence (AI) in FinTech

AI is revolutionizing the FinTech industry through greater efficiency and productivity, reduction of errors and risk assessment, improved customer experience, investment accuracy, and profitability, detection and prevention of fraud, performance efficiency and cost savings, and chatbots for customer service. Challenges include data bias, the need for

skilled professionals, and potential job loss.

Geo-Targeting and Personalized Marketing

Geo-Targeting and personalized marketing are becoming increasingly important in the BFSI industry, as they provide a means of building and maintaining customer trust and loyalty, improving customer experience, and driving revenue growth. Applications include fraud detection, risk assessment, and investment management.