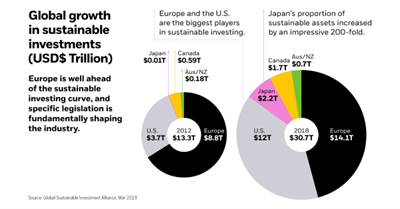

As sustainable investing gains popularity, investors and companies are increasingly considering environmental, social, and governance (ESG) factors alongside financial aspects. This approach aims to generate positive social and environmental outcomes while still achieving strong financial returns. In 2020, sustainable investment assets reached $35.3 trillion globally, a 15% increase from the previous year, and £1.2 trillion in the UK, accounting for over a third of all professionally managed assets in the country.

Identifying Passions and Priorities in ESG Investing

Identifying Passions and Priorities in ESG Investing

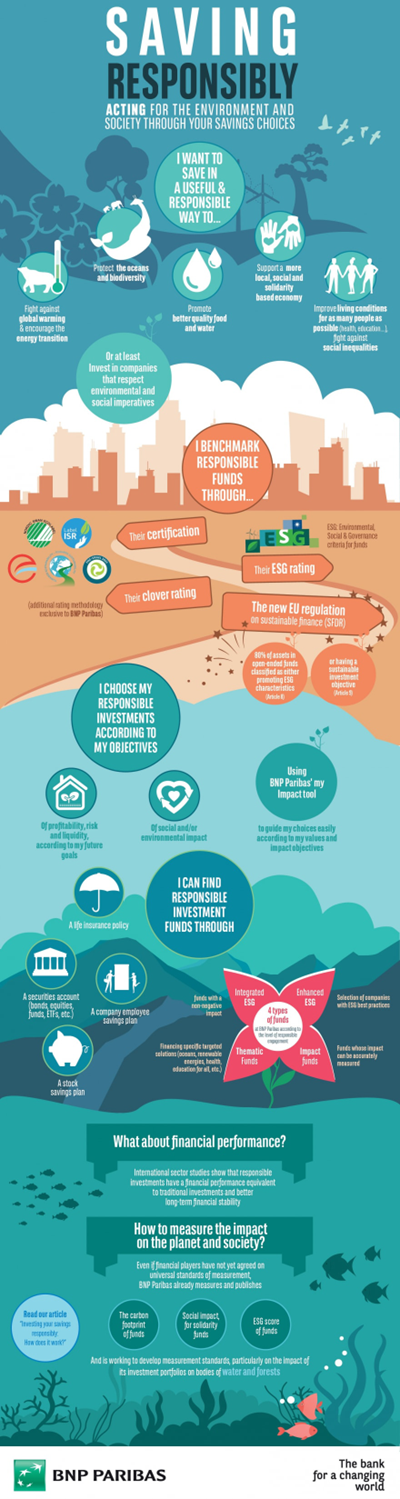

The first step in ESG investing is to identify your passions and investment priorities. Setting clear investment goals and prioritizing values can help investors avoid greenwashing, which is the practice of falsely overrating environmental standards or impact to deceive stakeholders. ESG scores are the most popular way for investors to evaluate ESG compliance and the performance of companies and funds. To make informed decisions, investors should do their own research, including reading about the company’s ESG disclosures, sustainability reports, and investment reviews.

ESG Savings Options and Personalized Indexing

ESG savings options include 401(k) or Individual Retirement Account (IRA) funds offered by major brokerages. Personalized Indexing (PI) is a custom-tailored approach to ensure funds align with employees’ investment values. ESG ETFs are baskets of stocks and bonds that can be bought and sold at any time and depend on fluctuating market conditions. For example, Commonwealth Equity Services LLC increased holdings in iShares MSCI Global Impact ETF by 13.3% in Q4 of the previous year, with major investors such as Royal Bank of Canada and Jane Street Group LLC also increasing their stakes in the ETF.

Online Trading Platforms for Sustainable Investing

Online Trading Platforms for Sustainable Investing

Online trading platforms provide a convenient and efficient way for investors to make sustainable investments. These platforms allow investors to buy and sell a wide range of financial products, including stocks, bonds, ETFs, and mutual funds. Many trading platforms offer tools and resources to help investors screen for sustainable investments and evaluate the ESG performance of individual companies. UK-based trading platforms that specialize in sustainable investing include Ethex and Nutmeg.

Future of ESG and Impact Investing

Despite the growing trend of sustainable investing, ESG-focused funds have faced challenges. Total assets under management in ESG funds fell by about $163.2 billion globally during the first quarter of 2023 from the year before. A confluence of political, geopolitical, and market events has severely damaged interest in ESG investing.

Greenwashing also became prevalent, hurting the movement’s reputation. However, ESG ratings are expected to become part of the toolkit for investment managers, ensuring that sustainable investing remains a vital component of the financial world.