Financial stability is a crucial aspect of life, and mastering money management is the key to building a solid financial foundation. This article will provide essential tips on budgeting for couples, building wealth without an inheritance, and advice from influential financial experts.

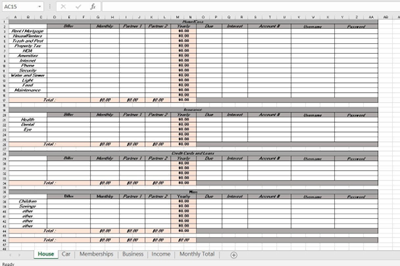

Budgeting for Couples: Strengthening Bonds and Building a Strong Financial Foundation

Creating a budget strategy that works for both partners can strengthen the bond between couples. It is essential to list down all potential sources of income and joint expenses, grouped into 12 typical household budgeting categories. Reviewing expenses regularly and having important conversations about money can help couples build a strong financial foundation together.

Tips for Building Wealth without an Inheritance

Starting a business, investing in the stock market, and exploring alternative assets like crypto and real estate are reliable ways to build wealth. Living below your means and improving financial literacy can also contribute to wealth-building. Young athletes or those who come into sudden wealth should create a realistic budget and learn to say “no” to monetary requests, focusing on growth capital and expanding investment knowledge.

Advice from Influential Financial Experts

Mark Cuban and Dave Ramsey are among the financial experts who emphasize the importance of paying yourself first and living on what’s left. Their advice centers around money management and includes personal anecdotes about the importance of saving.

The Ultimate Buy and Hold Strategy for Long-term Investors

Part 1 of a series intended for do-it-yourself investors, this article discusses the best way to build an equity portfolio without relying on expensive managers or trying to outguess and beat the market. The author advocates owning equal portions of nine equity asset classes, in a combination referred to as The Ultimate Buy and Hold Strategy. An initial investment of $100,000 in the S&P 500 at the start of 1970 would have grown to $18.9 million by the end of 2022, while a portfolio made up of equal parts of that index plus the nine asset classes listed above, with annual rebalancing, would have grown to $41.8 million.