Artificial intelligence (AI) and machine learning are transforming the world of personal finance, making financial advice and management more efficient and accessible. The advent of large language models (LLMs) has enabled AI to excel at tasks that were once the domain of human experts, and their applications in finance are becoming increasingly widespread.

LLMs: The New Frontier in Financial Advice

LLMs: The New Frontier in Financial Advice

Both individual users and big banks are harnessing the power of LLMs to revolutionize financial management. In fact, LLMs have been found to be more helpful than human experts in answering financial questions. The Common Law of Agency provides a legal framework for AI financial advisers that can adapt to rapidly changing technology and the U.S. Securities and Exchange Commission (SEC) has issued guidance on robo-advisers, which were powered by more limited algorithms than today’s LLMs.

Text-Based Interfaces and Open-Ended Inputs

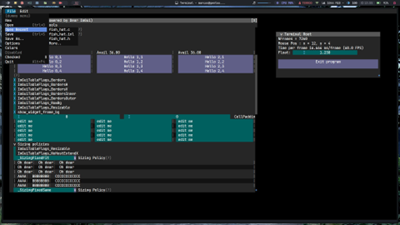

LLMs have text-based interfaces that take open-ended inputs, allowing them to provide personalized financial advice without being hardcoded to implement specific investment theses. This flexibility is a key advantage of AI-driven financial management, as it enables users to receive tailored guidance based on their unique financial situations and goals.

Policy Challenges and the Need for Regulation

Policy Challenges and the Need for Regulation

As AI continues to reshape the financial landscape, policymakers must respond to the rise of AI in finance. However, their track record on novel financial technology is not reassuring. Society has more experience with financial regulation than with preventing an artificial superintelligence from causing harm, highlighting the need for a proactive approach to AI regulation in the financial sector.

AI’s Expanding Role in Performance Measurement

AI is also transforming the way organizations measure performance, offering new perspectives on what drives success and how to assess it. Key performance indicators (KPIs) are being generated and refined with AI and performance data, both with and without human intervention. Google, for example, used supervised machine learning techniques to identify new high-performance parameters for underperforming marketing investments, uncovering surprising metrics that were most influential in driving success.