In the ever-changing world of finance, mastering the art of wealth management is crucial for long-term financial success. By employing effective strategies and learning from past experiences, investors can navigate the complex financial landscape and achieve their goals. This article will explore key tips and strategies for mastering wealth management and ensuring long-term success.

Focus on the Long Term

Focus on the Long Term

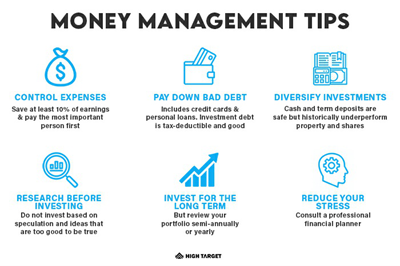

One of the most important aspects of wealth management is maintaining a long-term perspective. Short-term market fluctuations can be unpredictable, but by focusing on long-term growth, investors can minimize risks and maximize returns. This approach requires patience, discipline, and a clear understanding of your financial objectives.

Diversify Your Portfolio

Diversify Your Portfolio

Diversification is a key strategy for managing risk and ensuring long-term financial success. By spreading investments across various asset classes, investors can reduce the impact of market fluctuations and protect their wealth. This can include a mix of stocks, bonds, real estate, and alternative investments, tailored to individual risk tolerance and financial goals.

Have a Clear Investment Plan and Stick to It

Have a Clear Investment Plan and Stick to It

Developing a well-defined investment plan is crucial for successful wealth management. This plan should outline your financial objectives, risk tolerance, and investment time horizon. By sticking to this plan, investors can avoid making impulsive decisions based on short-term market movements and maintain a disciplined approach to wealth management.

Conduct Thorough Research on Companies and Stocks

Conduct Thorough Research on Companies and Stocks

Before making any investment decisions, it’s essential to conduct thorough research on companies and stocks. This includes analyzing financial statements, understanding industry trends, and evaluating management teams. By gathering comprehensive information, investors can make informed decisions and minimize risks associated with their investments.

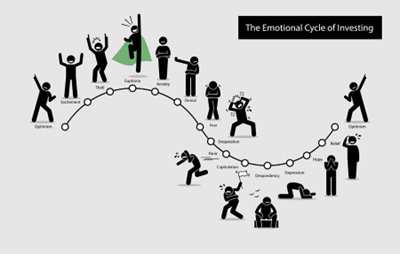

Manage Your Emotions and Avoid Impulsive Decisions

Emotions can play a significant role in investment decisions, often leading to impulsive choices that can negatively impact long-term financial success. By managing emotions and maintaining a disciplined approach, investors can avoid making costly mistakes and stay on track toward achieving their financial goals.

Learn from Mistakes and Adapt Strategies as Needed

Learn from Mistakes and Adapt Strategies as Needed

No investor is perfect, and mistakes are inevitable. However, learning from these mistakes and adapting strategies as needed can lead to long-term success. By continually evaluating performance and adjusting investment strategies, investors can improve their wealth management skills and achieve their financial objectives.