Exchange-Traded Funds (ETFs) have become increasingly popular among investors due to their diversification, flexibility, and cost-effectiveness. This comprehensive guide will help you navigate the world of ETFs and make informed investment decisions.

What are ETFs?

ETFs are a type of investment fund that trades on stock exchanges, much like stocks. They can track various indices, sectors, and asset classes, providing investors with a wide range of investment options. ETFs can be bought and sold throughout the trading day, offering flexibility to investors.

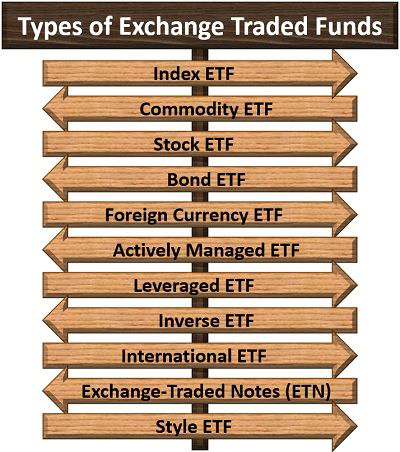

Types of ETFs

There are different types of ETFs based on their structure and strategy. Some ETFs use physical replication, meaning they hold the underlying assets of the index they track. Others use synthetic replication, which involves using derivatives to replicate the performance of the index. ETFs can also have passive or active management strategies. Passive ETFs aim to replicate the performance of an index, while active ETFs seek to outperform the index through active management.

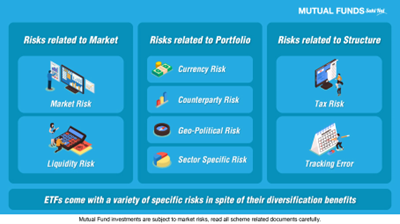

Risks and Fees Associated with ETFs

Investing in ETFs comes with various risks, such as market, liquidity, and counterparty risks. Market risk refers to the possibility of the ETF’s value declining due to market fluctuations. Liquidity risk arises when there is insufficient trading volume, making it difficult to buy or sell the ETF. Counterparty risk is the risk that a party involved in a transaction, such as a derivative counterparty, fails to fulfill its obligations.

ETFs also have different fees, such as management expense ratios (MERs) and trading commissions. The MER is the annual fee charged by the ETF provider while trading commissions are fees charged by brokers for buying and selling ETFs. It’s essential to consider these fees when choosing an ETF to invest in.

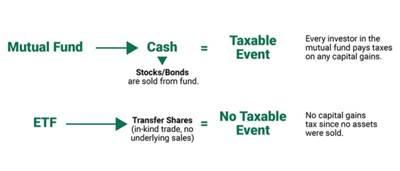

Tax Implications of ETFs

ETFs can have different tax implications, such as capital gains and dividends. When you sell an ETF at a higher price than you bought it, you may be subject to capital gains tax. Additionally, some ETFs distribute dividends, which may be subject to dividend tax. It’s crucial to understand the tax implications of your ETF investments and consult with a tax professional if needed.