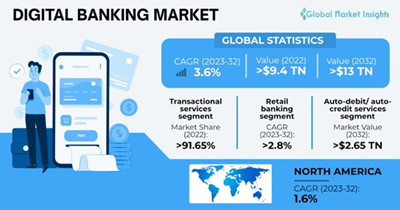

Neobanks and digital-only banks have emerged, offering new products and services that have lured customers away from traditional financial institutions. With the global digital banking market expected to have a CAGR of 13-14% from 2023 to 2030, the popularity of digital and mobile banking services has led to significant growth in the digital banking market. The COVID-19 pandemic has accelerated the adoption of digital banking solutions, and key players in the digital banking market include JPMorgan Chase & Co., Bank of America Corporation, and Wells Fargo & Company.

Apple’s Entry into Banking and the Rise of Neobanks

Apple has begun offering banking services, including a high yield savings account with a 4.15% interest rate. This move by Apple could lure customers away from traditional financial institutions and encourage other non-bank entities to get involved in banking. Digital-only banks, also known as neobanks, are gaining popularity as they offer a fully digital banking experience without physical branches. Prominent players in the neobanking market include Atom Bank PLC, Fidor Bank Ag, Monzo Bank Ltd., N26, Revolut Ltd., and Simple Finance Technology Corp.

Embedded Lending and the Future of Banking

Neobanks are working in partnership with third-party embedded lending vendors to provide SMEs with a platform to access vital finance at the point of need. Embedded lending integrates credit or financing products into non-financial businesses, allowing customers to access finance when they need it from a brand they trust. By harnessing a customizable API or white-label solution, neobanks can seamlessly integrate frictionless embedded lending options into their technology ecosystem. The entire lending process becomes faster, simpler, and frictionless, and SMEs can focus on using the funds rather than applying for them.

Challenges and Opportunities for Traditional Banks

Traditional banks should focus on innovation and delivering better digital banking tools to keep up with competition. Customers still value relationships and trust, which traditional banks can leverage by delivering a personal touch while also being innovative. Financial institutions are focusing on improving customer experience by offering personalized services and seamless digital experiences. Banks that don’t keep up with digital services may lose customers to those that do.

Regulatory Challenges and the Future of Neobanking

The digital banking market is facing regulatory challenges as governments and regulators try to keep pace with technological advancements. Neobanks are subject to different rules and regulations, which can be a double-edged sword. The new banking market is projected to reach a value of USD 2229.03 billion by 2030, with a CAGR of 53.4% over the forecast period (2022-2030). The rise of digital wallets has increased demand for online banking platforms, and the ability of neo bank platforms to provide simplicity and ease of processes in expenses to vendors and other stakeholders by reducing human intervention is expected to drive segment growth.