Understanding the difference between being wealthy and being rich is crucial in making a clearer impact on your definition of wealth. Being wealthy is about accumulating assets and resources that generate income for long-term financial security while being rich is about a consumption-focused mindset and a luxurious lifestyle, which can lead to overspending and neglecting building wealth for the long term.

Characteristics of Wealth

Wealth is characterized by a diverse portfolio of investments, passive income streams, financial independence, and long-term financial planning and stability. Having a high income or possessing a substantial amount of money does not guarantee financial stability or lasting prosperity. It is essential to focus on building a strong foundation for your financial future by creating a retirement income plan that is tailored to your specific needs.

The Retirement Income Challenge

The retirement income challenge involves managing the distribution part of retirement, which is a monumental task. The accumulation process can be compared to riding a ski lift while managing distribution is like skiing down a mountain. There are many questions that need to be answered when transitioning from accumulation to distribution, including how to create an inflation-adjusted stream of income that will last for the rest of one’s life.

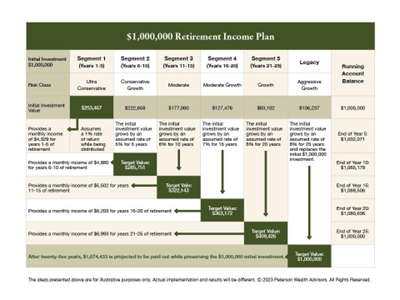

Creating a Retirement Income Plan

A well-thought-out retirement income plan will provide discipline, order, safety, and peace of mind. It is essential to create a plan that is unique to each individual’s specific needs, as this will help ensure a smooth transition from a career’s worth of accumulations into a stream of income that will last through retirement. This plan should take into account various factors such as inflation, market fluctuations, and personal financial goals.

Conclusion

Investing in your future is a crucial aspect of building wealth and financial security. By understanding the difference between being wealthy and being rich, focusing on creating a diverse portfolio of investments, and developing a well-thought-out retirement income plan, you can ensure a stable and prosperous financial future for yourself and your loved ones.