Financial freedom is a goal many people strive for, and one of the keys to achieving it is reducing debt and ensuring long-term security. This article will discuss strategies for minimizing risk in passive real estate investing and provide tips for managing personal finances to achieve financial freedom.

Minimizing Risk in Passive Real Estate Investing

Passive real estate investing can be a lucrative way to create income and grow assets, but it also carries the potential for loss. To minimize risk and maximize returns, follow these five simple steps:

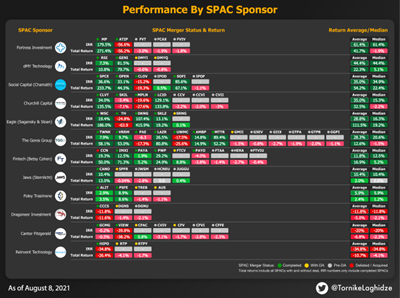

- Know the Sponsor and Assess Their Track Record

Before investing in a passive real estate opportunity, research the sponsor and their track record. Look for a history of successful investments and a strong reputation in the industry.

- Mitigate Market Risk

Understanding the current market and the measures the sponsor is taking to mitigate risks is crucial. Look for investments in stable markets with strong growth potential and ensure the sponsor has the plan to navigate market fluctuations.

Personal Finance Strategies for Reducing Debt and Achieving Long-Term Security

Managing personal finances effectively is essential for reducing debt and achieving long-term security. Here are some strategies to help you reach your financial goals:

- Automate Bill Payments and Use Accounting Software

Automating bill payments ensures timely payments and can help avoid late fees and penalties. Using accounting software can simplify financial management and provide valuable insights into your financial health.

- Create a Budget and Consolidate Debt

Creating a budget helps track income and expenses, making it easier to identify areas for improvement. Consolidating debt can simplify payments and potentially lower interest rates, making it easier to pay off debt faster.

3. Negotiate with Creditors and Monitor Credit Score

Negotiating with creditors can help avoid defaulting on debt and damaging your credit score. Monitoring your credit score regularly ensures accuracy and can help identify areas for improvement. A good credit score provides access to better loan rates and financial products, further supporting your journey to financial freedom.