Financial decision-making is a crucial skill for anyone looking to achieve success in the world of investing. In this article, we will explore essential strategies for mastering the art of financial decision-making, focusing on the use of chart patterns in penny stock trading. By understanding and recognizing these patterns, traders can unlock the true potential of penny stocks and seize profitable opportunities.

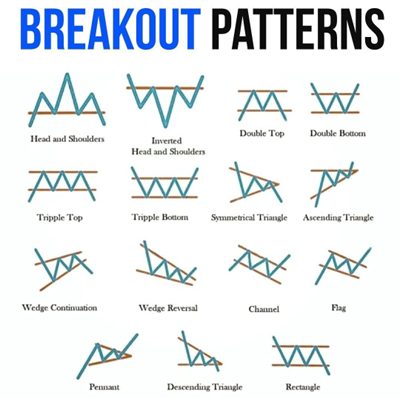

The Breakout Pattern

The Breakout pattern is a critical chart pattern for penny stock traders. This pattern occurs when a stock’s price moves above a specific resistance level, indicating strong upward momentum. By identifying this pattern, traders can better understand the stock’s behavior and identify potential Breakout opportunities. Once a Breakout is confirmed, investors can enter the market with a buy order, positioning themselves to profit from the anticipated price increase.

The Bull Flag Pattern

The Bull Flag pattern is another essential chart pattern for penny stock traders. This pattern is characterized by a sharp price increase, followed by a period of consolidation where the price moves sideways or slightly downwards. The consolidation phase resembles a flag on a pole, with the flag representing the period of consolidation. The Bull Flag pattern is a bullish signal, indicating that the stock price is likely to continue rising once the consolidation phase ends. By identifying this pattern, traders can position themselves to profit from the anticipated upward movement by buying the stock during the consolidation phase.

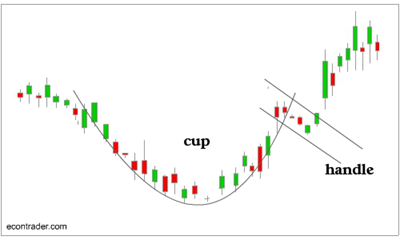

The Cup and Handle Pattern

The Cup and Handle pattern is a third crucial chart pattern for penny stock traders. This pattern consists of two distinct phases: the first phase, the “cup,” is a rounded U-shaped bottom, while the second phase, the “handle,” is a slight downward trend that follows the cup. The Cup and Handle pattern indicates that the stock is consolidating before potentially breaking out to new highs. By identifying this pattern, investors can strategically enter the market just as the stock begins its next leg up.

Key Takeaways for Financial Decision-Making Success

Understanding and recognizing chart patterns is instrumental in navigating the world of penny stocks and achieving financial success. By mastering the art of reading chart patterns, traders can unlock the true potential of penny stocks and seize profitable opportunities. The Breakout pattern, the Bull Flag pattern, and the Cup and Handle pattern are crucial for successful penny stock trading. To effectively use these chart patterns, investors must first familiarize themselves with the stock’s trading history and establish a clear picture of the stock’s behavior. By doing so, they can make informed financial decisions and achieve success in their investments।