Dividend investing is a popular and effective strategy for maximizing your profits in the stock market. By focusing on companies that pay consistent and growing dividends, investors can enjoy a steady stream of income while also benefiting from potential capital

appreciation. In this guide, we will explore the key principles of dividend investing and provide practical tips for building a successful dividend portfolio.

Understanding Dividends and Dividend Stocks

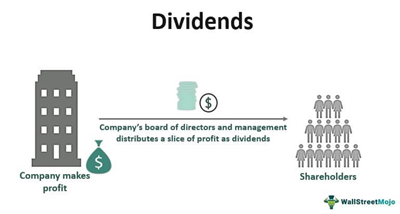

Dividends are payments made by companies to their shareholders, typically on a quarterly basis. They represent a portion of the company’s profits and are usually paid out in cash or additional shares of stock. Dividend stocks are those that have a track record of paying regular dividends and are often considered more stable and reliable investments compared to non-dividend-paying stocks.

Key Principles of Dividend Investing

There are several key principles that investors should keep in mind when building a dividend-focused portfolio. First, it’s important to focus on companies with a strong track record of dividend growth. This indicates that the company has a stable business model and is committed to returning value to shareholders. Second, investors should look for companies with a sustainable dividend payout ratio, which is the percentage of earnings paid out as dividends. A payout ratio that is too high may indicate that the company is not reinvesting enough in its business, which could lead to slower growth and a reduced ability to maintain or increase dividends in the future. Finally, diversification is crucial for managing risk in a dividend portfolio. By investing in a variety of sectors and industries, investors can reduce their exposure to market fluctuations and ensure a more consistent income stream.

Building a Successful Dividend Portfolio

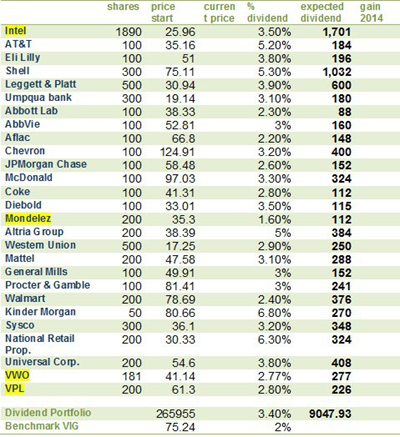

To build a successful dividend portfolio, investors should start by researching and identifying high-quality dividend stocks. This can be done by screening for stocks with a history of dividend growth, a sustainable payout ratio, and a competitive dividend yield. Once a list of potential investments has been compiled, investors should conduct further analysis to determine the overall financial health and growth prospects of each company. This may include reviewing financial statements, analyzing industry trends, and assessing management’s ability to execute growth initiatives. After selecting a diversified mix of dividend stocks, investors should monitor their portfolios regularly and make adjustments as needed to maintain an optimal balance of income and capital appreciation.

Conclusion

Dividend investing is a powerful strategy for maximizing profits in the stock market. By focusing on high-quality dividend stocks and adhering to the key principles outlined in this guide, investors can build a diversified portfolio that generates a steady stream of income while also offering the potential for capital appreciation. With diligent research and ongoing portfolio management, dividend investing can be an effective way to achieve long-term financial success.