Investing in startups has become an increasingly popular way for individuals and firms to diversify their portfolios and support innovative companies. With the rise of angel investing and venture capital, there are now more opportunities than ever to invest in early-stage companies. This article will explore the basics of angel investing and venture capital, as well as recent developments in the industry.

Angel Investing

Angel investing involves individuals providing capital to startups in exchange for ownership equity or convertible debt. These investors, known as “angels,” typically have high net worth and are looking to support promising companies in their early stages. Platforms like AngelList have made it easier for entrepreneurs to connect with angel investors and formalize their operations. For example, Julie Wroblewski, who left her role at Pivotal Ventures, started Magnify Ventures, a venture capital firm that invests in technology for families and caregivers. Magnify Ventures’ portfolio includes caregiving app company Papa and social activity platform company Element3 Health.

Venture Capital

Venture capital firms pool funds from various sources, such as institutional investors and high-net-worth individuals, to invest in startups with high growth potential. These firms typically invest in companies at various stages, from seed to later-stage funding rounds. Emblem, a European seed fund founded by Bénédicte de Raphélis Soissan and Guillaume Durao, recently raised nearly $54 million for investments in tech companies. The fund focuses on Swedish, Danish, and French startups in verticals such as AI, B2B SaaS, fintech, the future of work, and digital health.

Challenges and Trends in the Industry

While angel investing and venture capital offer exciting opportunities, there are also challenges and trends to consider. Ankur Nagpal, who founded Vibe Capital, recently decided to shrink his $70 million venture fund by 43% and return money to investors. This decision was driven by a shift in the funding environment and a desire to focus on his own startup. Other solo general partners (GPs) are also facing challenges, such as shrinking fund goals and teaming up with investors to avoid risk.

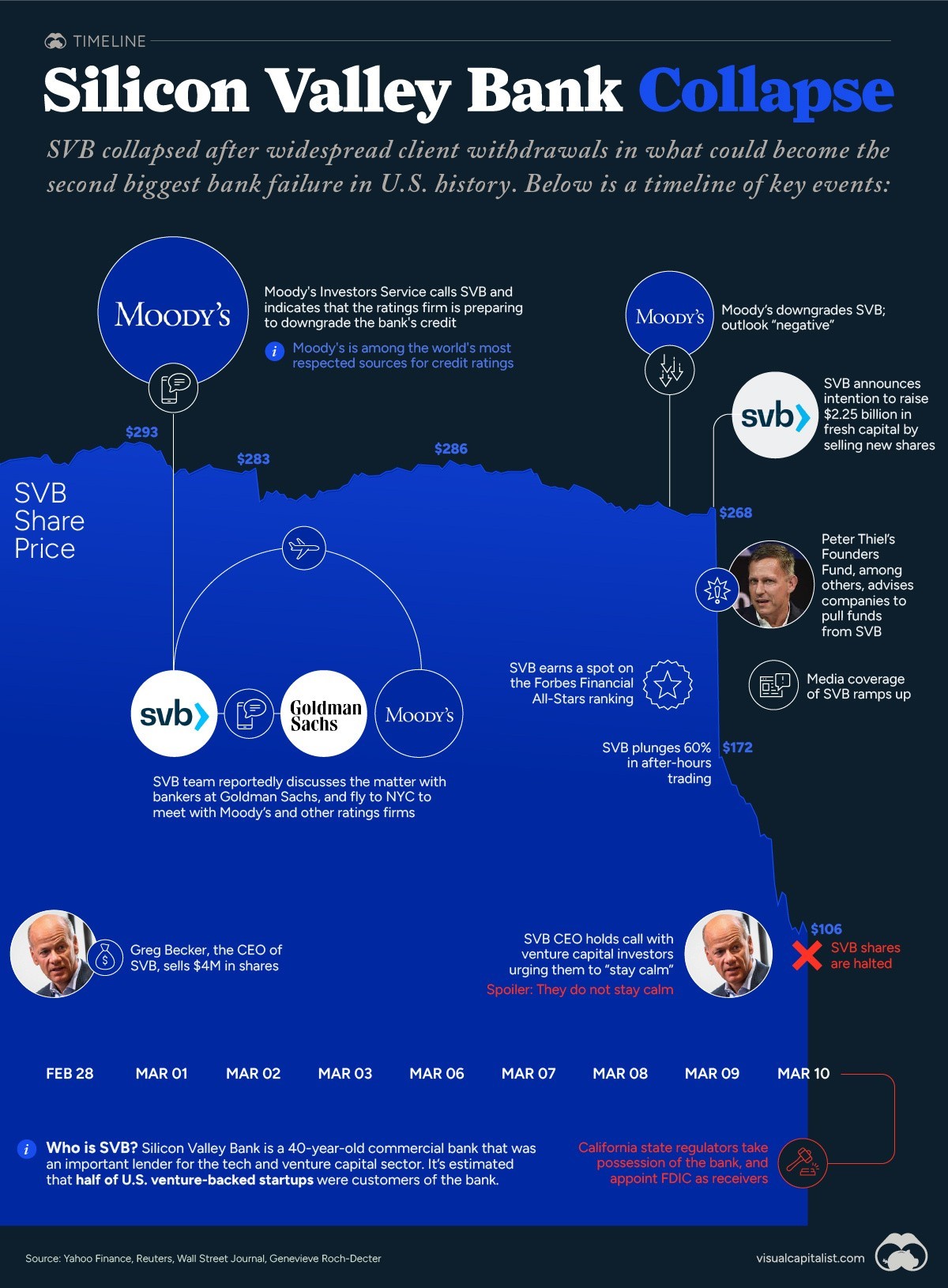

Impact of Silicon Valley Bank’s Collapse

The recent collapse of Silicon Valley Bank (SVB) could have significant implications for the startup funding environment. Rising interest rates and mismanagement are believed to be the cause of SVB’s downfall. A survey by NFX of over 800 founders in their network found that more than half believe SVB’s collapse will make fundraising even more challenging. However, some venture capitalists see this as a short-lived issue rather than a long-term problem for startups seeking fresh capital. The long-term effects of SVB’s collapse remain unknown, but it may lead to a shift toward funding businesses with the potential for medium-term profitability.