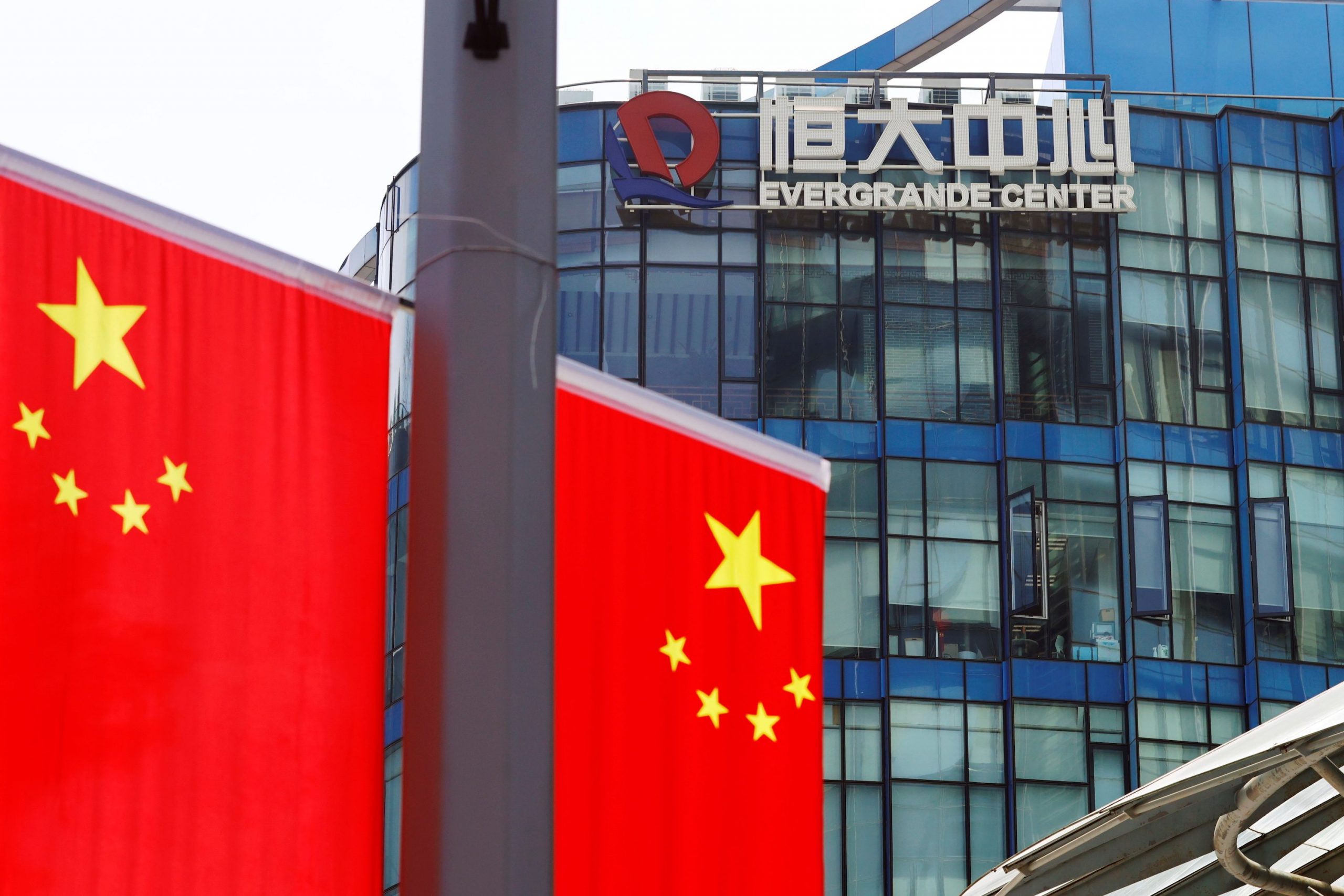

The world’s most indebted company Evergrande has failed to meet interest payments to international investors. These Chinese property giant liabilities exceed $300bn. It seems the crisis for this company has worsened after this incident.

The world’s biggest credit rating agency Fitch has declared Evergrande in default. So, investors are in fear of contagion across China’s property and banking sectors. According to Fitch, Evergrande had to repay interest on about $1.2bn of international loans. But they had been failed to transfer the money. It is thought the recent move will hamper the company’s restructuring talks with investors. Because Fitch’s risk ratings are closely followed by major investors.

In the last few months, Evergrande has been selling its assets. The company was trying to raise the money it owes. A huge number of customers, investors, and suppliers are waiting to receive money from this company. The company shared a statement last week. In that statement, they stated it could not guarantee “to perform its financial obligations”.

Businessman Hui Ka Yan founded Evergrande in 1996. At that time, it was known as the Hengda Group. Currently, it owns more than 1,300 projects. Evergrande Real Estate is operating in more than 280 cities across China. It not only manufactures foods and drinks but also makes electric cars and manages wealth. Now it also owns one of the country’s biggest football teams Guangzhou FC. According to Forbes, Mr. Hui was once Asia’s richest person. His gross amount of wealth is more than $10bn.

Last few years Evergrande has expanded its business and become one of China’s biggest companies. But Beijing government establish a new rule to control big real estate developers and Evergrande had to offer its properties at major discounts. As a result, they are struggling to meet the interest payments.